News

THANKS TO THE APPRENTICESHIP TAX, YOU'RE INVESTING FOR TOMORROW!

The taxe d'apprentissage (apprenticeship tax) is a compulsory tax payable by companies based on their total payroll. It is also the only tax that contributes to the development of our students' education, and which you can allocate as you see fit.

Agnès is in charge of collecting the Taxe d'Apprentissage at UniLaSalle.

She will guide you through the process of allocating the balance of the 2024 Apprenticeship Tax.

Agnès SYLVANO : 03 44 06 76 05

agnes.sylvano@unilasalle .fr

As an Alumni, you have the opportunity to invest in the future of UniLaSalle students.

Paying the balance of the apprenticeship tax to the school gives us the opportunity to offer our engineering students new teaching tools and equipment, and to enable them to work on new, innovative projects.

In this way, you'll contribute to greater employability.

Today's students are tomorrow's colleagues and collaborators, and will be part of the Alumni network alongside you.

Don't hesitate to take part in this long-term commitment!

By allocating your apprenticeship tax balance to UniLaSalle, you're investing for tomorrow.

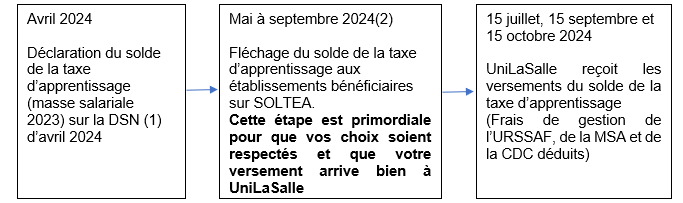

The Law for the Freedom to Choose one's Professional Future of September 5, 2018 has modified the circuit for collecting and distributing the balance of the apprenticeship tax. Processes have become more complex.

We need your support and involvement alongside UniLaSalle so that your company can direct the balance of its apprenticeship tax towards UniLaSalle's training courses.

(1) DSN: Déclaration sociale nominative (nominative social declaration)

(2) As the precise timetable has not yet been published, we invite you to follow its development on the https://www.soltea.gouv.fr/espace-public/ website.